By Joseph Callaway

I’ve been asked this question in one form or another lately from so many people. The reasoning is that a lot of folks lost their jobs for at least part of 2020. Also, most lenders allowed payment deferrals and those repayments will soon be coming due. Surely, we are heading for another 2007/2008 market collapse all over again.

Sorry to burst your bubble but there will be no bubble this time around. How can we be so sure? Well, the underlying conditions are different today. Back in 2005 and 2006 the market skyrocketed upward due to wild speculation and easy money. Buyers with no business owning a home were able to qualify for no documentation loans, “doctor feelgood” appraisers were asking “How much do you want it to appraise for?” and lenders were punching the tickets for the ride. The expectation back then was that a buyer could just hold the property a few months and then resell at a profit. When the bubble burst, Maricopa County housing inventory swelled to more than sixty thousand unsellable homes. The banks stepped in and prices dropped by half.

Today’s market rise is much different. Now, we have a shortage of homes for sale. Some days we have only 8,000 homes on the market and some months we sell more houses than that. This has driven prices up, increasing everyone’s equity.

A homeowner who cannot pay their mortgage today because of the pandemic will easily be able to sell their house long before the 90-day foreclosure process could take it away from them. Actually, this market could quickly go to 20,000 homes with no downward pressure on price. So, breathe easy and have no fear. This market is solid. You can buy today with confidence and reasonably expect to sell whenever you want to.

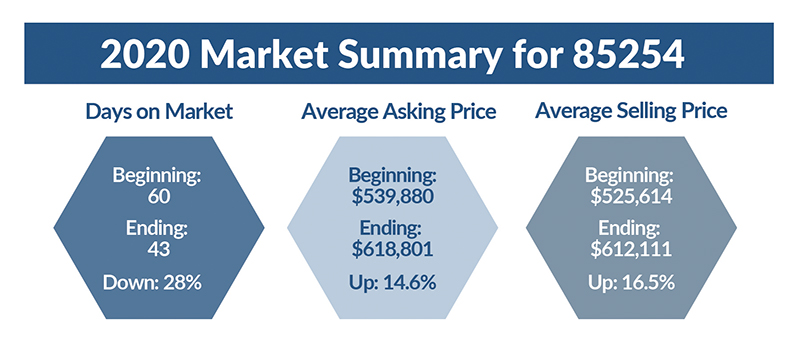

Joseph Callaway is co-owner of Those Callaways Real Estate, Arizona’s leading independent brokerage located in the Magic 85254 zip code.