By Scott Gaertner

Nobody likes to think about water damage—until it’s too late and six figures are on the line. Whether you live here year-round or head north for the summer, water damage is one of the most expensive and sneaky threats to your home. And the worst part? It usually starts quietly, behind a wall or under an appliance—until it explodes into a full-blown disaster.

Let me tell you two real stories—both recent, both heartbreaking, and both entirely avoidable. And both happened right here in Scottsdale North.

The first was a full-time Scottsdale North couple in their 80s. They were actually living in the home when their refrigerator’s water line started leaking—but they had no idea until the damage was already widespread. We were in escrow on their $1.7 million home, and the leak hit at the worst possible time. The water had a field day with their beautiful Hickory floors—hand-scraped by Amish craftsmen—it ran underneath and spread before anyone noticed. We lost the buyer. The home sat for months during repairs, and when it finally went back on the market, it sold for $50,000 less than before. Thankfully, insurance picked up the $300,000-plus tab—but it didn’t cover the emotional toll. The stress on this couple was intense. We helped them relocate earlier than planned to be near family and took over managing the repairs—but the toll it took on them was very real.

The second was another Scottsdale North resident—a Canadian client who wasn’t even in the country. He was back in Canada for the summer while the fridge leaked undetected for months. When he finally returned, the damage was staggering—again, well over $300,000. But here’s the kicker: his insurance denied the claim. Why? Because his policy required someone to physically check on the home every two weeks. He couldn’t prove that anyone had been checking in on the home, so the insurance company said, “Sorry,” and he got stuck with the bill. Ouch.

These stories aren’t one-in-a-million. I wish they were. I hear versions of them every single year. And every time, the homeowner says something like, “If only I had known…” So now you know. Let’s keep this from being your story next year.

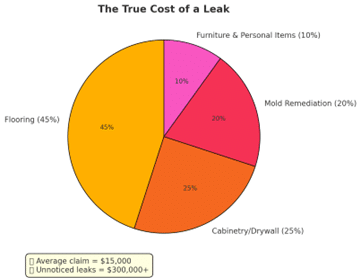

If you’re wondering where all that money actually goes, take a look at the chart below. It breaks down the average cost of a water damage claim—and as you’ll see, the biggest hit usually isn’t from what you expect.

Here’s what you can do—starting today:

Step 1: Shut off your water.

If you’re leaving town for more than a few days, turn off the main valve. No water running means no water leaking. It’s the cheapest peace of mind you’ll ever get. And if you don’t have an easy-to-access shutoff valve, get one installed. It’ll cost less than $500 and could save you from a six-figure disaster.

Step 2: Install water sensors.

These are little battery-powered devices that sit quietly behind your fridge or under your sink and shout “Hey! We’ve got a problem!” straight to your phone if they detect water. One of our readers did the homework the rest of us didn’t want to—deep research, comparisons, the whole deal—and found a great one: YoLink. (Thank you Dan!) I now recommend it to everyone. It’s easy to set up, lasts forever, gets great reviews, and just works—no drama.

Step 3: Have someone check in.

Whether it’s a neighbor, a friend, or a home-watch service, have someone walk through the home regularly—and keep a record. Some insurance policies require proof of these visits, and without it, they might leave you high and (not so) dry.

None of this is rocket science, but it can save you from a six-figure headache. One cheap sensor or a quick twist of a shutoff valve could have changed everything for those two homeowners.

To make this even easier, I’ve put together a free guide called “Don’t Let Water Leaks Drain Your Wallet: A Homeowner’s Guide to Avoiding Expensive Problems.” It’s packed with practical tips and the best tech tools to protect your home. And as a bonus, the first two people to request it will get a free YoLink water sensor pack! Just head to: ScottGGroup.com/homeowner-help

Safe travels—and may the only thing soaking your home this summer be sunlight.

And don’t forget to grab that free guide while you’re thinking about it.