By Scott Gaertner, Associate Broker

My June article described how the Scottsdale North real estate market was changing. I wrote that piece on May 15, so that it could be in newsstands and your mailbox by June 1. While I sensed that the changes were going to be significant, it was still too early to be sure, or to provide you with the evidence. We have the data for that evidence now. But, to begin, I think this quote from Michael Orr (the Oxford mathematician from the Cromford Report) sums the change up well:

“The collapse between April and June is unprecedented—faster and more violent than we have ever witnessed. This is due to a very rapid decline in demand coupled with an explosive rise in supply.”

Contract Ratio

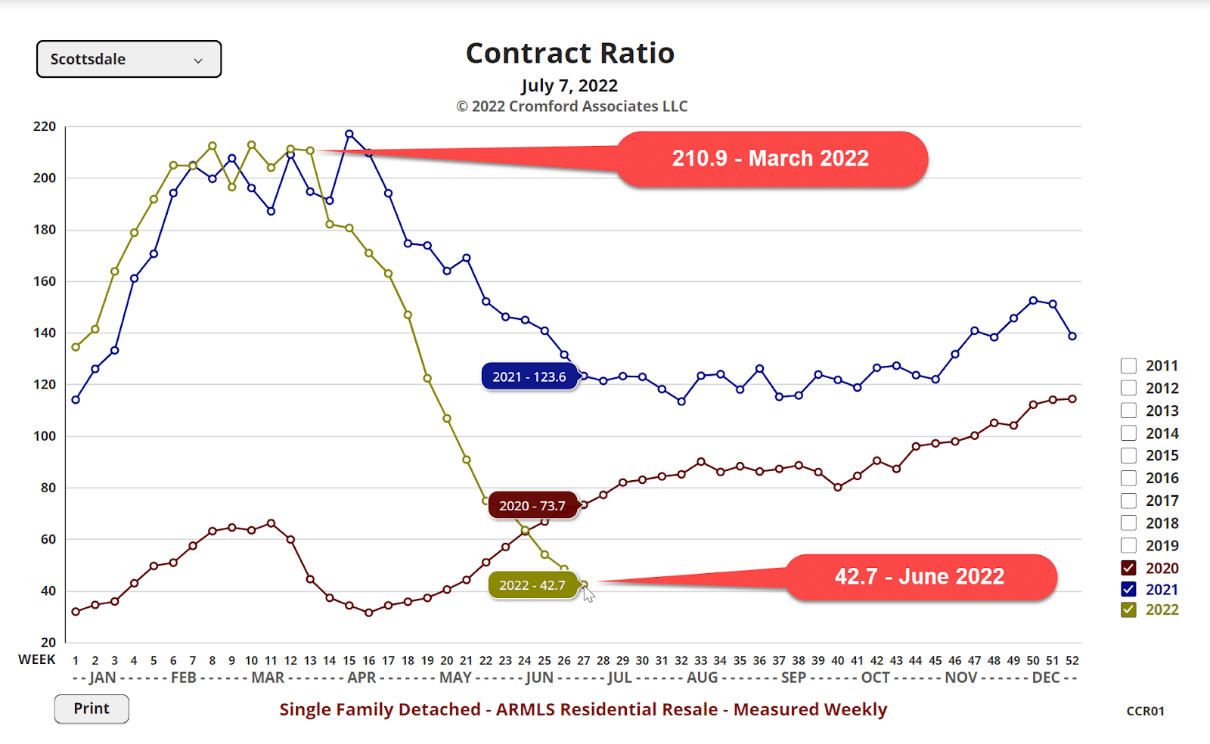

To demonstrate the extent of the market shift, I need to introduce you to a new metric. The Cromford Market Index is not helpful in this situation since it is too average-based and eliminates trivial daily differences. However, the Contract Ratio is a straightforward measurement that has no smoothing or averaging effects. As a result, it is far better suited to determining how “hot” a market is and is particularly responsive to abrupt changes in the market.

Quick Explanation

The Contract Ratio specifically measures the number of completed sales contracts relative to the supply of active listings. The higher the number, the greater the buying activity relative to supply. In a balanced market for normal market segments, the value of the Contract Ratio is usually between 30 and 60. When it lies below 20 the market can be considered “slow” or a “cold market.” Above 60 can be considered a “hot market” and when it moves above 100, we regard this as evidence of a “buying frenzy.” Below is the 2022 Weekly Contract Ratio Chart for Scottsdale.

As you can see in just the short time from mid-March until the end of June, the Scottsdale Contract Ratio has slipped from 210.9 to just 42.7. That takes us from a very hot seller’s market to a balanced or neutral market in just four months. We have never experienced that kind of a downturn in such a compressed period.

Regarding the unprecedented, compressed nature of the shift Michael Orr says, “When a housing cycle changes from positive to negative, we normally go from euphoria to uneasiness for a few months, followed by several months of denial and then several more months of pessimism before we get to the panic phase. This is what played out in 2005 and 2006. But in 2022, it seems to have taken just a week or two to skip through each of these steps and gone from euphoria to panic in no more than 10 weeks. After the first round of sharp rises in mortgage rates, everyone was so willing to believe that the market was about to fall that it became a self-fulfilling prophecy.”

The market is not crashing. We are seeing balance return to the housing market as competition eases due to the Fed’s effort to dampen demand by raising interest rates. The housing market hates uncertainty, and we have buckets full of uncertainty right now. But that is temporary. It could take months to clear, but it is temporary. In the macro picture, our market still has far more demand than supply.

I mentioned in June’s article that in times like these, caution is advisable, fear is not. Panic can lead to mistakes and a mistake right now will be exponentially more expensive than in a normal market. Let’s choose data over drama during this time.

Data over Drama

I will be here providing data and direction. If you like to do your own research, I caution you about going to the internet. I assume you all understand how to avoid the pitfalls of identity theft, hacking, and viruses, but the accuracy of information you can get is questionable. There are so many competing interests on the internet, and most are driven to try and get your information. Every search opens you up to spamming and phone calls because the best information is behind paywalls. We have found the two simplest and least invasive tools available for you to watch the market. If you would like to keep up with home values in your neighborhood, go to noseyneighbor.com. If you rather keep up your own Scottsdale North home value in an email once per month, go to scottsdalenorthvalue.com.

As always, if you have any questions, I’m available to discuss all things real estate.

Scott Gaertner is an Associate Broker with Keller Williams Northeast who for the past 35+ years has helped more people find their lifestyle niche in the Scottsdale North area than anyone else. He also contributes his thoughts on the real estate market and lifestyle interests in the area and is the creator of ConnectingScottsdaleNorth.com. For additional info, visit ScottGaertnerGroup.com or call 480-634-5000.