While few things in life are certain or guaranteed, Michele Diamond, president of Diamond Retirement Strategies (DRS), makes a great point when she notes that, “Retirement is inevitable.” Because of this eventuality, Diamond and her dedicated team at DRS have worked with clients in all stages of retirement planning for over two decades and counting.

“No two clients will ever be the same, just like a fingerprint,” Michele says. “My company is built on a foundation of ensuring that clients receive an experience rather than just a transaction.” DRS provides a breath of fresh air while providing comprehensive and professional advice. This provides clarity and confidence to clients as they are guided through their personal retirement journey.

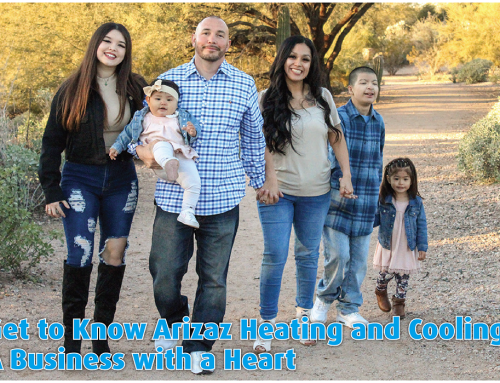

Your Go-To Retirement Experts

Diamond Retirement Strategies has been licensed and practicing for over 20 years, working to assist clients in all stages of retirement planning. DRS is currently licensed and active in 28 states nationwide—and counting. As independent agents, their team can work with numerous financial organizations as well as industry-related companies nationwide to assist with finding the right solution for clients’ current and future long-term goals.

“Whether you are looking to retire in the near future, are currently retired, or just exploring options, we can offer you a no-cost, no obligation consultation,” Michele explains.

Over the past 10 years, Michele has traveled across the country sponsoring retirement planning seminars. These events were designed to better assist those needing educational information on the several topics within retirement. Her team at DRS is dedicated to continuing education and is a member of the National Association of Insurance & Financial Advisors (NAIFA) as well as the National Association of Professional Advisors (NAPA).

In addition, DRS is also involved in local and national groups committed to supporting women and women business owners, which is Michele’s true passion.

“As a female business owner in a predominantly male industry, I feel it is necessary to empower other women. My goal is to encourage other women to take charge of their own retirement and help them to independently improve their financial future,” she explains. “My hope is that women will want to become more involved with the retirement planning process.”

During the recent pandemic, through online networking, webinars, and even virtual happy hours, Michele was able to stay connected and continue to make an impact in the community. This is when the “Women, Wealth, and Wine” concept was first established. This event is a fun, safe, and educational experience that allows women the opportunity to laugh, interact, share experiences, and learn from one another. Michele is a member of the International Association of Women (IAW), Women in Insurance & Financial Services (WIFS), and the National Association of Women Business Owners (NAWBO).

Retirement Planning and Strategies for Success

“We offer customized and individualized plans for clients at any age or stage in retirement,” Michele explains. “It’s never too early to start planning for retirement. People are living longer, and the cost of living is always going up. Social Security usually isn’t enough to cover all your retirement expenses, so a good time to plan for retirement is years before you plan to retire. This is the time to book a no cost, no obligation, free consultation with us.”

Michele shares that she has always been passionate about helping clients thoroughly understand the complexities of retirement by showing them easy-to-understand strategies. After meeting and listening to clients’ specific needs, she works with her team to provide individualized solutions.

“Retirement planning does not have to be a dull and boring experience,” she says. “As we partner with our clients, our goal is to create a strong foundation of understanding and transparency to allow for a more comfortable and stress-free experience. The process will seem more like a teeth cleaning rather than having to get a tooth pulled— so I promise it won’t hurt a bit!”

Diamond Retirement Strategies believes in putting clients first. “We strongly believe retirement income planning requires both a process and a personalized strategy to achieve optimal success. We are with you all the way,” she explains. “We work with companies that are financially sound and have a proven track record in their industry. We believe the best approach for retirement begins with a clear understanding of the lifestyle you would like to maintain for you and your family.”

Michele explains that when creating a retirement plan for one’s financial future, generally the client has two choices: the long-term growth potential of stocks or the lower returns of more conservative alternatives. “Ideally, you want your financial vehicle to offer the upside potential of stocks, with none of those downside risks,” she clarifies. “As independent agents, we can offer products of these types that are 100% safe from market volatility. Most importantly, these types of products can give you the security knowing that your life savings will always be protected, allowing for a better night’s sleep.”

“We like to say, ‘When the market is up, you’re up! When the market is down, you’re not!’ The vast majority of people are not aware these types of options even exist. Additionally, some can even offer you a guaranteed lifetime of income that you can never outlive,” she adds.

The team at DRS can show clients how to benefit when markets are rising, but most importantly, security when they fluctuate as we have all seen in recent months.

“Especially in retirement, most cannot afford to ‘ride-the-wave’ anymore,” she says. “With fixed income such as Social Security and if one’s lucky, a pension, it’s been shown that it may not be enough to continue one’s lifestyle in retirement. Concerns such as higher inflation, the ever-increasing cost of living, the never-ending rental wars with higher rates, increasing medical costs, and more are valid. The need for additional fixed income to last throughout your retirement is becoming a major concern for seniors in today’s world.”

Let Diamond Retirement Strategies Help You Today! Never Any Fees.

Because Michele and her team are licensed insurance agents and not brokers, they will never charge a fee for their consultations or when they take on a client. With a client-first approach, they will also meet with you wherever you are the most comfortable. This can be in person, on the phone, or even a Zoom meeting if you prefer.

At DRS, their motto is, “Successful strategies for successful planning.”

“Come see the difference when partnering with DRS,” Michele says.

To learn more about Diamond Retirement Strategies, visit drstrategies.org or call 480-750-2999.

This content is sponsored by Diamond Retirement Strategies.