By Frank May, Realtor

There has been discussion for months that interest rates won’t stay at the all-time lows we have seen the past six months. We have watched the interest rates creep up to just over 3.02% in the last few weeks, the first time since this past July. According to FreddieMac, this wasn’t a surprise and won’t affect the real estate market as you would think: “The rise in mortgage rates over the next couple of months is likely to be more muted in comparison to the last few weeks, and we expect a strong spring sales season.”

Any rise in interest rates isn’t what a buyer is looking for when obtaining a loan as home prices continue to rise. But let’s put the interest rates in comparison to years past. Here is how interest rates have changed over the years:

• 2020: 3.11%

• 2019: 3.94%

• 2018: 4.54%

• 2017: 3.99%

• 2016: 3.65%

Can you still afford a mortgage?

You bet you can! Let’s take a look at mortgage rates over the past 50 years.

• 1970s: 8.86%

• 1980s: 12.7%

• 1990s: 8.12%

• 2000s: 6.29%

• 2010s: 4.09%

• 2020s: 3.11%

As you can see from the 50+ years of interest rates, we are still at record-breaking lows. Even during the boom in the early 2000’s we didn’t see the push for lower interest rates like we have now. Although it’s a little more challenging to obtain a loan than it was then, the payments are significantly lower.

What does this mean for you as a seller?

An interest rate spike by even a whole point won’t be enough to flip the market to a buyers’ market. There is a big enough gap in the inventory available that it will be a bit before this even levels out. As I am writing this on March 17, the inventory of single-family homes in all of 85383 is a mere 54 homes available to purchase. It isn’t counting any under contract or accepting backups. (I went back into the MLS to refresh my screen while writing this, and it dropped to 53!)

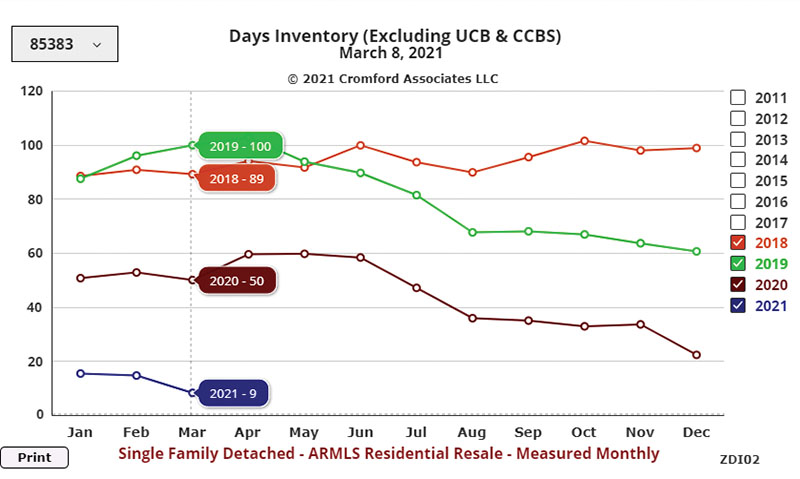

85383 is one of the fastest-growing zip codes to date in Arizona, with people moving into the area at a rate that surpasses the supply, and by a lot! It is correct for the Valley as a whole, but if you look at the included chart from The Cromford Report, it shows we are averaging nine days of inventory from 85383.

What this means is that if we were not going to get any more listings as active, we would run out of the supply of homes for sale in nine days. Looking back to two years ago today, we were at 100 days of inventory. A little over three months supply in 2019 has shifted to less than a third of a month’s supply—a notch over a week. There has never been a better time to sell your home than now. If you have been thinking about selling, but something is holding you back, I’d love to hear the reason and see if we can help. We have programs that can offer cash for your home, programs that can help you fix up your home to sell and pay at closing, and traditional selling methods to get you more money in less time and less stress than you might think.

Not sure where you can go after you sell your home? We have some ways to get you the home of your dreams and make top dollar for the home you are selling. Call us today at 623-203-1800.

Frank May grew up in the Valley, graduating from Northwest Christian School and NAU. He is a real estate agent with Keller Williams Realty and has been helping both buyers and sellers for 18 years. Frank May is also a Dave Ramsey Endorsed Local Provider.