By Louisa Ward

This is a question I get consistently from those who are currently renting and trying to navigate the plethora of news about the market and what they should do.

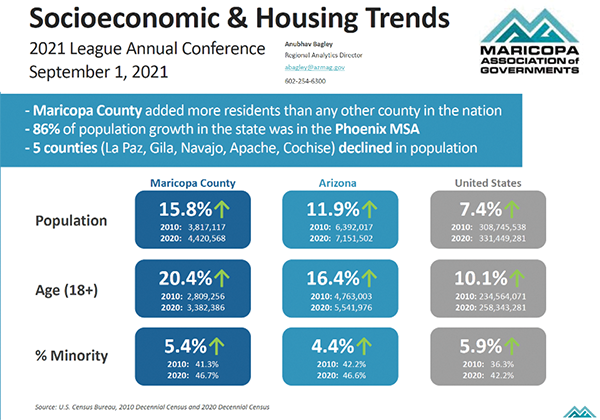

We still are in a strong seller’s market with supply inadequate to meet demand. However, it is also a landlord’s market and tenants are seeing their monthly rent skyrocket. Maricopa has added more residents than any other county in the country in the last 10 years. This is driving an intense demand for housing, both for sale and for rent. This demand is expected to continue into the foreseeable future.

Homeowners are going to see their monthly payments remain stable even though home prices are increasing. At the same time, renters are seeing their monthly rental amounts take a huge jump at renewal time. The media is bringing this issue to the consumers’ attention with recent headlines like “Phoenix rents increased 20% since August 2020” on ABC 15 and “Phoenix-Area Rents Are Approaching the Most Expensive In The Country” in the Phoenix New Times.

Current Median Rental Prices In 85028 & 85032

In 85032 the monthly median rent for a single-family home is $2,298. The median sales price is $450,000, and with 10% down, has a monthly PITI (principal, interest, taxes and insurance) payment of $1,949.

In 85028, the monthly median rent for a single-family home is $2,798. The median sales price is $620,000 and, with 10% down, has a monthly PITI payment of $2,678.

The monthly payment is less than the monthly rental amount, but that’s not all. During the time that you are renting, you are paying your landlord’s mortgage and he/she is reaping the benefits of the increased appreciation. It is fiscally more sensible to pay your own mortgage and benefit from the appreciation as the home increases in value.

Benefits of being a homeowner:

• Paint whatever color you want, plant a garden, get a dog or two, all without asking permission of the landlord.

• When you decide to move, as a homeowner, you will likely have money in your pocket from the sale. Renters receive no cash benefit when they move.

• As a homeowner, keep your monthly payments stable even when the prices are increasing.

While this information poses a strong argument in favor of buying versus renting, whether you should buy a home depends on your personal situation and financial picture.

You’re in a strong position to buy a home if you have:

• A steady job

• A down payment saved up

• A great credit score

• Low levels of debt

But if you’re not in such a strong position, it could pay to postpone your home search. Perhaps you’re worried about getting laid off at work, or you don’t have any money set aside for a home purchase. Or maybe you have a lot of debt, or your credit score needs work. It may make sense to wait.

Buying a house isn’t cheap. You’ll have to pay thousands of dollars before you even move in, including closing costs associated with your mortgage and a down payment. You should buy when you know that you are committed to staying in one place for at least a few years.

Deciding whether or not to buy a house isn’t always an easy decision. That’s why it’s smart to partner with a local Realtor that specializes in the area you desire, is very knowledgeable about the market, and who can help you navigate your options.

Louisa Ward is a senior partner at My Az Realty Team and RE/MAX Excalibur. She is part of the Top 2 percent of Realtors in Phoenix and Scottsdale with 25 years of experience. Louisa is also an active member of the North 32nd community, serving as a local real estate expert, member of the PV Village Planning Committee, and a Mountain Preserve Block Watch leader. To learn more, visit MyAZRealtyTeam.com, call 602-769-6699, or e-mail [email protected].