By Scott Gaertner, Associate Broker

The last 18 months changed what many buyers are looking for in a home. Recently, the American Institute of Architects released their AIA Home Design Trends Survey results for Q3 2021. The survey reveals the following:

• 70% of respondents want more outdoor living space

• 69% of respondents want a home office (48% wanted multiple offices)

• 46% of respondents want a multi-function room/flexible space

• 42% of respondents want an au pair/in-law suite

• 39% of respondents want an exercise room/yoga space

If you’re a homeowner who wants to add any of the above, you have two options: renovate your current house or buy a home that already has the spaces you desire. The decision you make could be determined by factors like:

1. A possible desire to relocate.

2. The difference in the cost of a renovation versus a purchase.

3. Finding an existing home or designing a new home that has exactly what you want (versus trying to restructure the layout of your current house).

In any case, you’ll need access to capital: the funds for the renovation or the down payment your next home would require. The great news is that the money you need probably already exists in your current home in the form of equity.

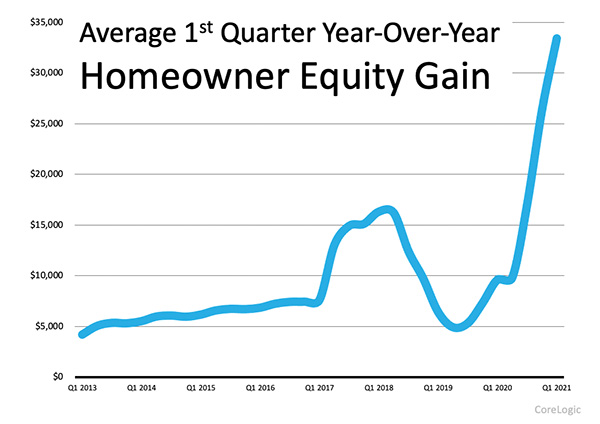

Home Equity Is Skyrocketing

The record-setting increases in home prices over the last two years dramatically improved homeowners’ equity. The graph above uses data from CoreLogic to show the average home equity gain in the first quarter of the previous nine years.

Odeta Kushi, Deputy Chief Economist at First American, quantifies the amount of equity homeowners gained recently: “Remember U.S. households own nearly $35 trillion in owner-occupied real estate, just over $11 trillion in debt, and the remaining $24 trillion in equity. In inflation-adjusted terms, homeowners in Q2 had an average of $280,000 in equity – a historic high.”

As a homeowner, the money you need to purchase the perfect home or renovate your current house may be right at your fingertips. However, waiting to make your decision may increase the cost of tapping that equity.

Most Scottsdale North homeowners have the means to renovate their home completely should they so choose. But with interest rates still at historic lows, and the stock market being bullish, you may not want to. If you decide to renovate, you could refinance (or take out an equity loan) to access the equity. If you choose to move instead and use your equity as a down payment, you might want to mortgage the remaining difference between the down payment and the cost of your next home.

Waiting to leverage your equity will probably mean you’ll pay more to do so. Mortgage rates are forecasted to increase over the next year. According to the latest data from the Federal Housing Finance Agency (FHFA), almost 57% of current mortgage holders have a mortgage rate of 4% or below. If you’re one of those homeowners, you can keep your mortgage rate under 4% by doing it now. If you’re one of the 43% of homeowners with a mortgage rate over 4%, you may be able to do a cash-out refinance or buy a more expensive home without significantly increasing your monthly payment.

First Step: Determine the Amount of Equity in Your Home

If you are ready to either redesign your current house or find an existing or newly constructed home that has everything you want, you first need to determine how much equity you have in your current home. To do that, you’ll need two things:

1. The current mortgage balance on your home.

2. The current value of your home.

You can probably find the mortgage balance on your monthly mortgage statement. To find the current market value of your house, you can pay several hundreds of dollars for an appraisal, or you can contact a local real estate professional who will be able to present to you, at no charge, a professional equity assessment report.

Bottom Line

If the past 18 months have refocused your thoughts on what you want from your house, now may be the time to either renovate or make a move to the perfect home. If you are wondering how much equity you have in your home, we can help. Just let us know, and we can prepare a free no-obligation Professional Equity Assessment Report. Just let us know by emailing us at [email protected] or give us a call at 480-634-5000.

Scott Gaertner is an Associate Broker with Keller Williams Northeast, who for the past 25+ years has helped more people to find their lifestyle niche in the Scottsdale North area than anyone else. He also contributes his thoughts on lifestyle interests in the area.