By Scott Gaertner

Without a doubt, the most common question I get these days is: “Why is the market so hot in the middle of a pandemic?” With the help of Mike Orr and The Cromford Report, I will give you some thoughts on this.

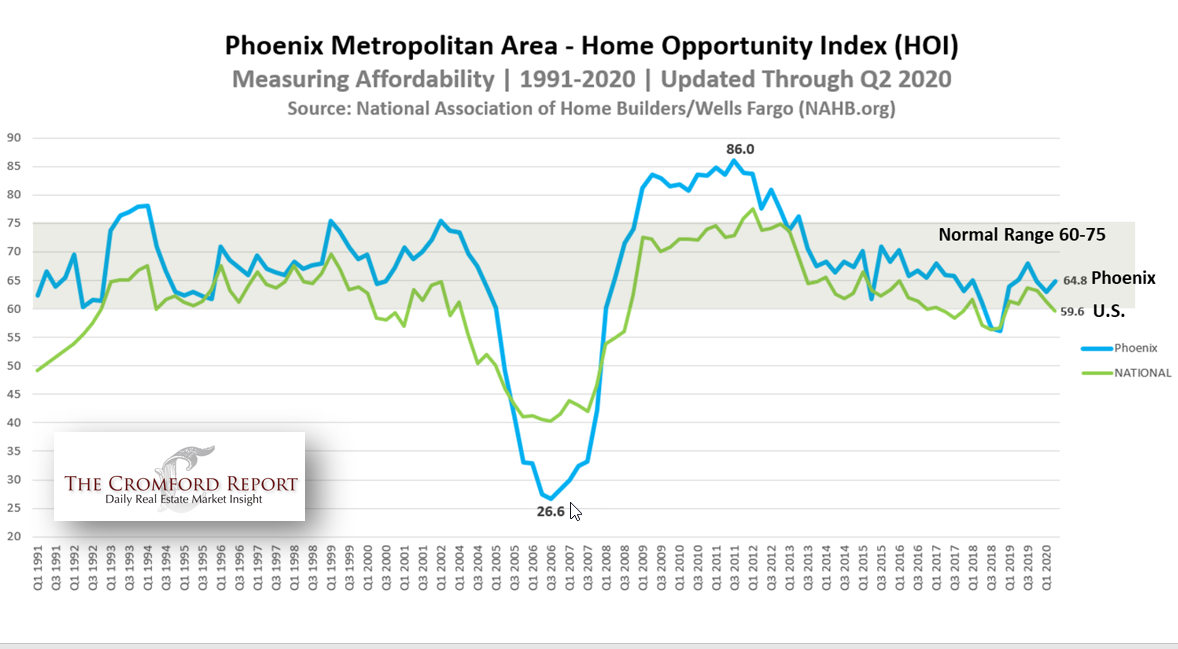

Housing Opportunity Index

The Housing Opportunity Index (HOI) for a given area is defined as the share of homes sold in that area that would have been affordable to a family earning the local median income, based on standard mortgage underwriting criteria.

As you can see in the chart above, the Valley HOI is more affordable than most areas of the United States, and it’s trending higher. When you then factor in that our weather is better than much of the country, our taxes are lower, and job opportunities stronger, I think you can see why folks might want to come here.

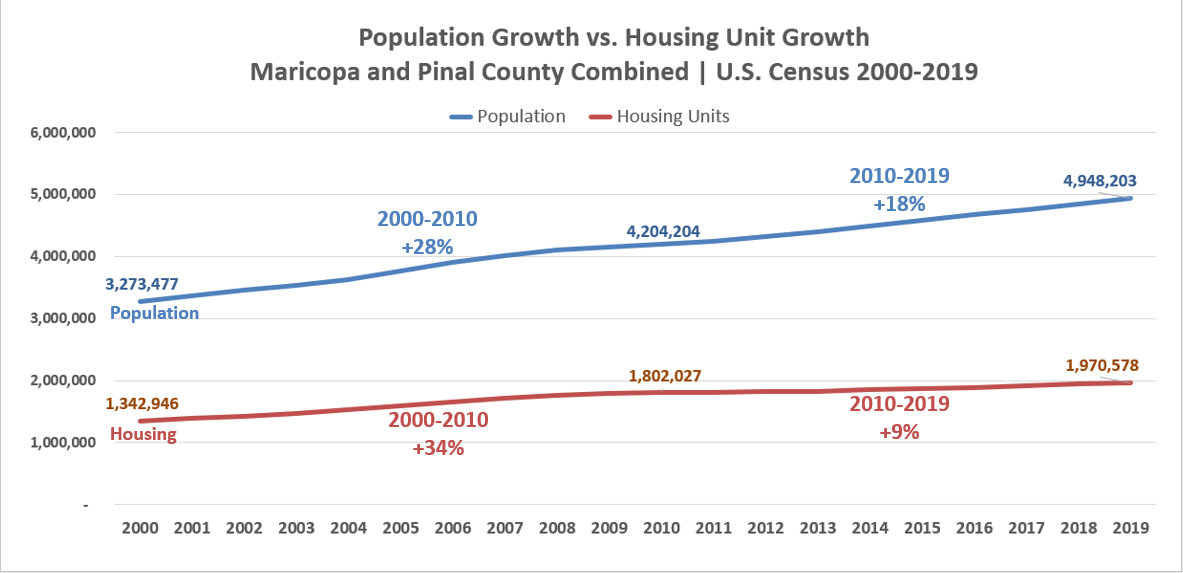

Why Are Prices Moving Up So Fast?

We don’t have enough homes. Above, you can see that the blue population growth line is badly outpacing the red housing unit growth line. The market crash of 2008 put many home builders out of business and dissuaded those who survived from overbuilding. They are working now to catch up but land, lumber, steel, and labor are all in short supply and getting much more expensive.

How Has This Impacted Our Market?

The market keeps setting new records for dollar volume sold. The monthly figure for all areas and types is $4.518 million as of November 14. This is up an astonishing 54% from the same time last year.

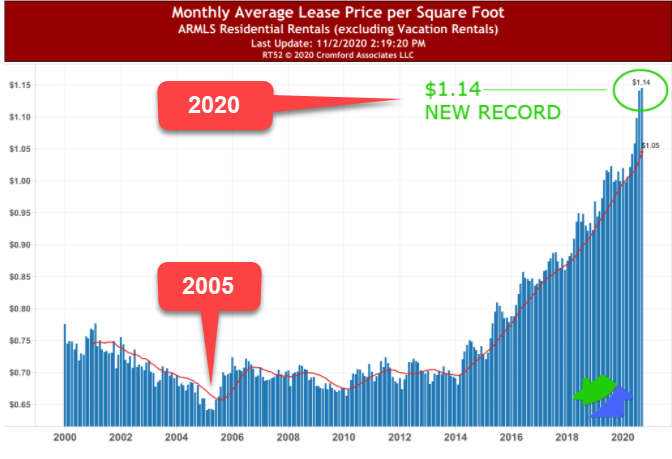

To put this in context, the dollar volume at the peak of the bubble in 2005 was $3.339 million which occurred during June that year. By June 2005 peak, demand had already been detected and the market was sliding toward disaster as a slew of supply came onto the market from wise speculators getting out early. The current situation has market dynamics that bear little resemblance to 2005. Demand for single-family homes in all 17 of the Valley’s largest cities has increased, and while supply crept up in early October, it is now trending down in almost every market.

The Luxury Market Is On Fire

Despite the pandemic, our luxury real estate market is seeing exponential growth way beyond expectations. Last month we had our highest number of sales for luxury real estate, priced $1 million and over, in the past 20 years with almost 400 sales, beating the highest record set the previous month.

During October there were 101 closed listings across Greater Phoenix with prices over $2 million. This is a genuinely colossal total, given that the previous record for October was 38. In fact, it is quite rare for the over $2 million count to exceed 50 during any month. The monthly total has exceeded 66 only three times. All three of those times have been during the last four months. We had 41% more closed listings over $2 million this year than in 2019. Also, in October, we saw 37 closed listings over $3 million. This is not only the highest total for any October in history, it is the highest total for any month in history.

Let’s Put Talk Of A Bubble To Bed

All the info above bodes well if you are a Scottsdale North homeowner. But it also might bring up concerns about the market now resembling the run-up and subsequent crash of 2005. The short answer is that we are in a very different demand situation. Investors buying with fake loans oversaturated the rental market back then, driving rents down to historic lows. Today rentals are in such demand we set new rent rate records every month. Consider the chart below:

I hope that answers some of your questions, but if not, just give us a call. If you are wondering what your home is worth, go to ScottsNorthHomeValue.com for a free valuation.

Scott Gaertner is an Associate Broker with Keller Williams Northeast, who for the past 25+ years has helped more people to find their lifestyle niche in the Scottsdale North area than anyone else. He also contributes his thoughts on lifestyle interests in the area.