By Frank May, Realtor

Wow! The market is continuing to surge. There is no bubble in the near future. We have unprecedented lows in inventory. Is there an end in sight? I don’t know. I have a hard time imagining the home prices going up more, but every week, there has been an increase in price per foot. I don’t have a crystal ball. I do have The Cromford Report, which is the most detailed collection of statistics of Arizona home sales that I have ever seen.

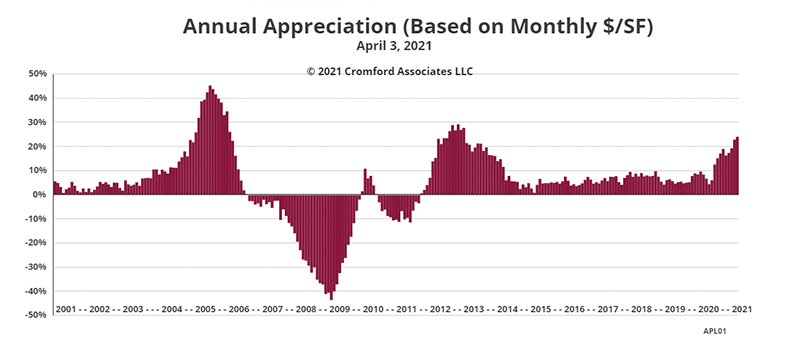

You may remember the housing boom of 2005. Arizona had its peek appreciation month in August 2005, hitting 45.4% appreciation. As of April 3, we are on trend to almost hit that number by the end of the year. The Cromford Report states, “Average sale dollar per square foot has risen over 13% in the last four months, equivalent to an annual appreciation rate of almost 40%.”

If we continue the trend we are on we will be just shy of the 2005 all-time high. It’s hard to put this in perspective. Mike Orr of the Cromford Report states, “You will probably notice that we are forecasting that sales prices will be significantly higher than list prices over the next month.” Giving us a little bit of insight into how the appreciation can increase so much over a short period.

What does this mean for buyers?

If you plan on buying a home right now, you have your work cut out for you. It no longer matters if the house appraises (it likely won’t) or the asking price. There are far too many buyers to sellers now, causing multiple offers on the home, driving up the sales price—forcing buyers to get creative with their offers. Waiving appraisals, inspections, paying the sellers closing costs, and offering to let the sellers stay in the home after selling, among other things. As a buyer, I would not recommend ever waiving an inspection. If you have the cash to pay the difference on an appraisal and you are very serious about buying the home no matter what the appraiser’s opinion of value is, then, by all means, waive the appraisal.

You can shorten the inspection period and even offer on the house as-is, but I would advise you not to waive your inspection period. It is like shooting yourself in the foot if you waived everything only to find out the home needed about $75,000 in repairs you didn’t plan on, and you have now spent your money on the appraisal gap. Not a fun way to start the homeownership process.

Will we see the bubble burst?

I don’t have a crystal ball, so I can only speculate. I do know that if you want to sell in the next few months, likely through the end of the year, you will only make more money on your home as each month progresses. The rate that home prices are increasing at seems unreal to people in the industry, which continues to cause many to speculate on a bubble. But if you look at the amount of equity in homes, the average credit score it took to get a home is much higher than in 2005, no puffed-up loans, and banks don’t want to buy back the houses they loaned on (see more info at mayteam.com/blog/forbearance). Also, interest rates are still at incredibly low numbers, making home buying an affordable process. These combined make for a strong housing market with no signs of slowing down in the near future.

If you are thinking about selling your home, give us a call. We have strategies to get you what you want for the sale. And we are still putting buyers into homes weekly. Call us today at 623-203-1800 to discuss your home buying and selling needs. If you want to read more about buyers strategies and the home purchasing process, go to MayTeam.com/blog/homebuyers.

Frank May grew up in the Valley, graduating from Northwest Christian School and NAU. He is a real estate agent with Keller Williams Realty and has been helping both buyers and sellers for 18 years. Frank May is also a Dave Ramsey Endorsed Local Provider.