By John Cabezas with LIV AZ Realty

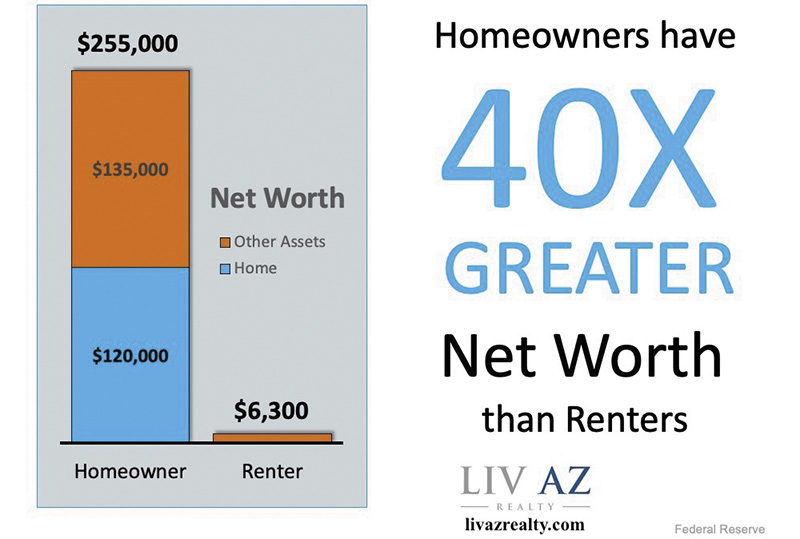

One of the most effective and best ways to build your family’s financial future is through real estate, primarily home ownership. In a recent study conducted by the Federal Reserve, it was found that the net worth of a homeowner is actually over 40 times greater than that of a renter. For the last seven years, studies have shown that home ownership is the single best way for the average American to create long-term wealth.

Not only has real estate ownership outpaced the stock market, but also the risk of loss is almost zero. The only time you will lose financially with homeownership is if you sell during a downturn, but real estate always recovers and exceeds the previous mark.

The Survey of Consumer Finances, a survey conducted every three years, clearly shows the breakdown of how owning a home helps build financial security. In the graph below, we see that the average net worth of homeowners continues to grow. During the same time, the net worth of renters tends to hold fairly steady and is significantly lower than that of homeowners. The gap between owning and renting just keeps getting wider over time, making homeownership more and more desirable.

Owning a home is the best way for the average American family to build wealth.

Statistically speaking, homeownership serves as a form of ‘forced savings’ for the average American family. It is no secret that most Americans have difficulty creating savings. Whether it is the economy, income, or lack of willpower, most Americans have very little savings.

Through a mortgage, every time you make a payment, you are adding to your equity. The longer you have your mortgage, the greater the amount of the payment that increases your equity.

Mortgage loans are amortized. This means that the first few years of your loan the majority of your payment goes toward paying the interest. The longer you have the loan the greater part of the payment that goes toward the principle.

Gallup reports that the impact of home equity is why Americans have picked real estate as the best long-term investment for the seventh year in a row. This year’s survey showed that 35% of Americans chose real estate over stocks, savings accounts, gold, and bonds.

Today’s real estate market is a great opportunity for those planning to buy a home. The housing market, especially in Arizona, has made a full recovery. Add to that historically low interest rates, and you have the perfect market conditions for homeownership.

If you’re ready, buying a home this fall can set you up to increase your net worth and create a safety net for your family’s future.

To learn how you can use homeownership to build your family’s net worth, contact us today at LIV AZ Realty. We will guide you through the home buying process and put you on your way to long-term financial health. You can reach us at livrealty.com or by phone at 480-399-7051 or 602-300-0797.